Many everyday products like cars and smartphones have several stages in their process of development, including design, sourcing of raw materials, assembly, and distribution. In today’s interlinked world, these activities often involve multiple countries across several regions together, making up a global value chain.

But why should you bother? Because international trade today is synonymous with global value chain. According to a 2023 OECD report, 70% of today’s international trade happens through the global value chain.

More importantly, till now, most of the high-end activities in the global value chain such as research and development and product design were concentrated in developed countries like the USA. In contrast, developing countries or emerging economies mostly focused on lower-value activities like product assembly and back-office support.

Consider, for example, the case of India. For years, multinationals have been setting up labor-intensive operations like IT support, mobile app development, accounting, and call centers in India—grunt work that could be cost-effectively done by the huge supply of talented manpower in India. This earned the country the nickname of the world’s back office.

The Changing landscape

But things have started changing. Slowly, businesses have realized that they can do a lot more in emerging economies like India, and this has led to the development of global capability centers. Today, these Global Capability Centers in India are delivering high-value activities like product innovation and AI for MNCs across the globe.

For example, consider the case of Mondelez. All chocolate and beverage innovations for Mondelez globally today happen from the company’s global technical center in Mumbai, India.

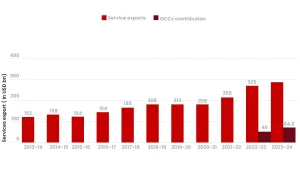

And the rapid expansion of the GCCs has just begun. In 2022–23, there were around 1,580 GCCs in India generating a total revenue of US $46 billion. Cut to 2023–24, and the number of GCCs operational in the country stands at 1,700+, and their total revenue contribution has seen a 40% jump to US $64.6 billion. Furthermore, it is projected that by 2030, there will be 2,200+ GCCs in the country, taking their revenue contribution to US $105 billion, or around 2% of the nation’s GDP.

That’s not all. The contribution of GCCs, or Global Capability Centers, to the country’s service exports is also growing. With a GDP growth rate of 6.2%, India is one of the fastest-growing major economies in the world. The country is projected to become the third largest in the world with a GDP of US $10 trillion by 2030. And one of the major contributors to India’s growth story is the service sector. While trade in goods has stagnated over the past decade, India’s service exports have more than doubled (124%).

However, a major boost in service exports in 2022–23 and 2023–24 came from the Global Capability Centers, as the following figure shows.

What’s Driving this Shift?

There are many factors that are driving this shift and making emerging markets the new hotspot for GCC expansion. Here is a list of some of those:

1. Derisk Supply Chains

Many of the new investments that MNCs are undertaking are primarily because they want to ‘derisk’ their supply chains. Some of the destinations that they are primarily choosing include India, Mexico, Vietnam, and Eastern Europe.

The need to ‘derisk supply chains’ became clear during the pandemic. China was always known as the world’s factory, as the easy availability of raw materials and cheap labor incentivized global companies to manufacture from the nation. However, this overdependence paralyzed several industries as China’s widespread curbs during COVID-19 severely disrupted global supply chains. This made businesses understand the risk of not derisking their supply chains.

Dave West, Cisco’s APAC president, echoes this when he says that the company is building a very agile and resilient supply chain and is encouraged to choose India because of all the advances happening in digital infrastructure, manufacturing, and other areas. For example, amidst the rising tariff escalations between the USA and China, Apple promised to shift its entire US-bound production line to India.

2. Market Size

India is forecasted to become a US$10 trillion economy by 2030, thus elevating it to the position of the third-largest economy after the USA and China. India’s consumer market is also forecasted to be US$4.5 trillion. This is India’s perceived strength—the size of the domestic market. So, MNCs targeting growth need to have a presence in the country.

3. Government incentives

The government has gone through several FDI reforms over the years that have incentivized MNCs to set up bases in the country. Other benefits like tax holidays also attract foreign MNCs to set up their global capability centers in the country. For example, GCCs set up within special economic zones benefit from exemptions on income tax on export profits and export duties.

Further, government schemes like ‘Make in India,’ ‘Start-up India,’ and ‘Digital India initiatives’ encourage innovation and have led to a thriving start-up ecosystem with over 150,000 startups and 100+ unicorns. India’s PLI scheme, along with high tariffs on imports, is also incentivizing companies to ramp up their production.

4. Cost Benefits

In comparison to other GCC destinations in Asia Pacific and Eastern Europe, India offers 25–35% cost savings to companies setting up GCCs. Moreover, in the tier-2 cities, talent and real estate are available 25–40% cheaper compared to their tier-1 counterparts, encouraging MNCs to explore new locations for setting up GCCs.

5. Manpower Availability

India is now home to one-fifth of humanity, and more than half of its population is under 30. Moreover, India is also home to 28% of the global STEM workforce and 23% of global software engineering talent. The country also has the second-largest talent pool globally of personnel trained in key digital skills like AI, machine learning, and data analytics. India’s population is also culturally curious and has a learner mindset, which makes them an asset for any organization.

6. Green Infrastructure

Easy access to green infrastructure and green power helps the GCCs or Global Capability Centers in India to support their parents’ net-zero commitment. India has set an ambitious target of achieving 500 GW from non-fossil fuel sources by 2030 and has already achieved 100 GW of installed solar power capacity in February 2025. Further, Reliance is contributing to this vision by building the largest single-site solar plant in Kutch, Gujarat, spread over 550,000 acres, and Adani is building the world’s largest green energy park in the Kutch area, spread over 538 sq. km, to generate over 30 GW of solar-wind hybrid power.

7. Digital Infrastructure

India has recently made massive strides in its digital infrastructure. The country has the largest 5G network in the world and leads in the amount of data traffic per smartphone. The massive penetration of data has also led to the growth of the country’s digital public infrastructure like UPI, Jan Dhan, Direct Bank Transfer, Aadhaar, etc. Incidentally, Aadhaar is also the world’s largest digital identity system.

The banking industry in the nation has also undergone a revolution, and 95% of banking transactions in the nation are now digital. Moreover, India’s home-grown Unified Payment Interface (UPI) recently clocked 20 billion transactions in a single calendar month.

Case Study: Story of Mobile Phone Manufacturing in India

Till about a decade ago, India imported most of the mobile phones for domestic consumption. However, thanks to the government’s production-linked incentive scheme, the country went from assembling less than 30% of its phones in 2014 to assembling 99% of the phones domestically consumed.

In the meanwhile, the value of India’s electronic production rose nearly fivefold from ₹1.9 trillion in 2014-15 to ₹9.5 trillion in 2023-24. However, the next leap involves the country starting to manufacture the components, including cameras, displays, semiconductors, printed circuit boards, etc.

But the country is slowly taking strides toward that goal. For example, Optiemus Electronics, in collaboration with Corning Incorporated, USA, has set up the nation’s first tempered glass manufacturing facility in Noida. India Semiconductor Mission has also approved 5 semiconductor units, which will receive state, government, and central subsidies under the program for developing semiconductors and display manufacturing ecosystems in India, with a total outlay of ₹76,000 crores.

Challenges in Setting Up a GCC or Global Capability Center in India

We have already mentioned above that setting up a GCC in India is about 25 to 30% cheaper than setting up a similar unit in European nations or other Asia-Pacific countries. However, you still have to shell out a considerable sum. For example, setting up a 50-employee GCC needs around $150K upfront investment. The costs can escalate if you are setting up a GCC for R&D or other specialized fields.

Moreover, you need to handle legal and regulatory compliance, along with spending a considerable sum to purchase IT infrastructure and office equipment. Additionally, you have to incur talent acquisition and onboarding expenses, including hiring costs, employee retirement, and health benefit fees, etc. These expenses, along with the added pressure of managing an entity in a foreign country, make it cumbersome for a small and medium business to set up and operate a GCC in India.

Hence, if you are looking for answers to how to set up a global capability center in India, the best solution is partnering with a cloud staffing organization. When you partner with an offshore staffing organization like Remote Resource®, you need not worry about any of the hassles mentioned above. The cloud staffing organization handles everything from employee onboarding to compliance, operational expenses, employee benefit costs, etc.

It’s like having your own office in India without the hassles. Your remote team, sourced from the country’s top 10% talent pool, works as part of your team and reports to you regularly, while your cloud staffing partner takes care of every worry that holds you back.

So, no need to set up your own global capability center in India. No need to lay out US$150K in upfront expenses or wait for months to fill vacancies. Just connect with us and start working with a dedicated team selected from India’s best talent within hours.