In today’s fast-paced corporate world, being efficient is no longer optional; it’s a must if you want to stay ahead of the competition. Most companies spend a lot of money on front-end growth initiatives, but they typically don’t pay attention to back-office activities like accounts payable (AP) until difficulties start to show up.

Here are five important signs that you should think about hiring a professional accounts payable service with competent remote workers to handle your accounts payable.

Red Flag #1: Your Team is Spending Too Much Time Doing AP Tasks Manually

If your staff spends a lot of time processing invoices, entering data, managing approvals, and following up with vendors, they are already less efficient.

Many firms that are growing still do their accounts payable work by hand or with some automation. As the number of transactions goes higher, finance teams have a hard time keeping up, and HR often has to step in to help out. This means that highly skilled workers have to do repetitive, low-value tasks instead of working on significant projects.

If you hire a specialist accounts payable solution, this problem goes away right away. Standardized workflows, automation tools, and experienced AP workers make it easier to process and approve invoices. Businesses can save money and time by using a skilled remote resource to do daily AP work instead of hiring more people.

Red Flag #2: People In Finance And Operations Roles Are Leaving Or Burning Out Quickly

People who work in accounts payable are known to get burned out quickly.

Accounts payable roles are notorious for high burnout. Tight deadlines, repetitive work, and constant pressure to avoid errors can quickly drain even experienced professionals.

When finance or operations employees leave, HR teams are left managing frequent recruitment cycles for roles that are difficult to retain and expensive to replace. The cost of hiring, onboarding, and training new AP staff adds up quickly, and productivity often drops during transitions.

A managed accounts payable service helps break this cycle. By outsourcing AP tasks to a stable team of remote resources, businesses eliminate dependency on individual employees. The service provider absorbs the responsibility for staffing, training, and continuity, while HR gains predictability and reduced hiring pressure.

Red Flag #3: Payment Errors and Vendor Complaints Are Becoming Common

Late payments, duplicate invoices, and unresolved discrepancies don’t just affect your books—they damage vendor relationships and your company’s reputation.

From an HR and employer branding perspective, these issues matter. Vendors, contractors, and partners interact with your organization regularly, and poor payment practices create friction and mistrust. Internally, employees are forced into reactive problem-solving instead of proactive work.

Professional account payable services are designed to minimize errors through checks, controls, and clearly defined processes. Dedicated AP specialists follow standardized procedures and service-level agreements to ensure accuracy and timeliness.

By using a qualified remote resource, businesses benefit from consistency and accountability without micromanagement, leading to smoother vendor relationships and fewer escalations.

Red Flag #4: Business Growth Is Outpacing Your Internal AP Capacity

Growth is a positive sign—but it can expose weaknesses in back-office operations.

As companies expand, invoice volumes rise, vendor networks grow, and approval workflows become more complex. Scaling an internal AP team fast enough to keep up is often unrealistic. Hiring takes time, and overstaffing during peak periods leads to inefficiencies during slower cycles.

An outsourced accounts payable service offers built-in scalability. Whether you’re entering new markets, handling seasonal volume spikes, or supporting mergers and acquisitions, a remote AP team can scale up or down based on demand.

For HR leaders, the remote resource model provides flexibility without long-term headcount commitments—allowing workforce planning to stay aligned with business realities.

Red Flag #5: The Risks Of Not Following The Rules, Being Audited, And Losing Data Are Growing

Regulatory standards and audit expectations are always changing, which makes it harder for finance and HR departments to keep their operations clean and compliant.

During audits, disorganized AP paperwork, inconsistent approvals, or not separating roles can all be very big problems. These risks often affect HR as well, especially when payments are for contractors, benefits, or expenses that are close to payroll.

A good accounts payable service provider puts compliance and security at the top of their list of objectives. Documented workflows, audit trails, access restrictions, and secure systems are required, not optional.

Businesses lower their risk of not following the rules and make things easier for their internal teams by hiring qualified remote workers who know about best practices for accounts payable.

What to Look for in a Partner for Accounts Payable

It’s really important to pick the correct companion. When looking at an accounts payable service, think about:

- Experience in your field that has been proven

- Clear ways to talk to each other and report back

- Strong management and monitoring of remote resources

- Secure technology and standards for compliance

- Ability to grow with your business

The best supplier should be more than simply a vendor; they should be like an extra member of your team.

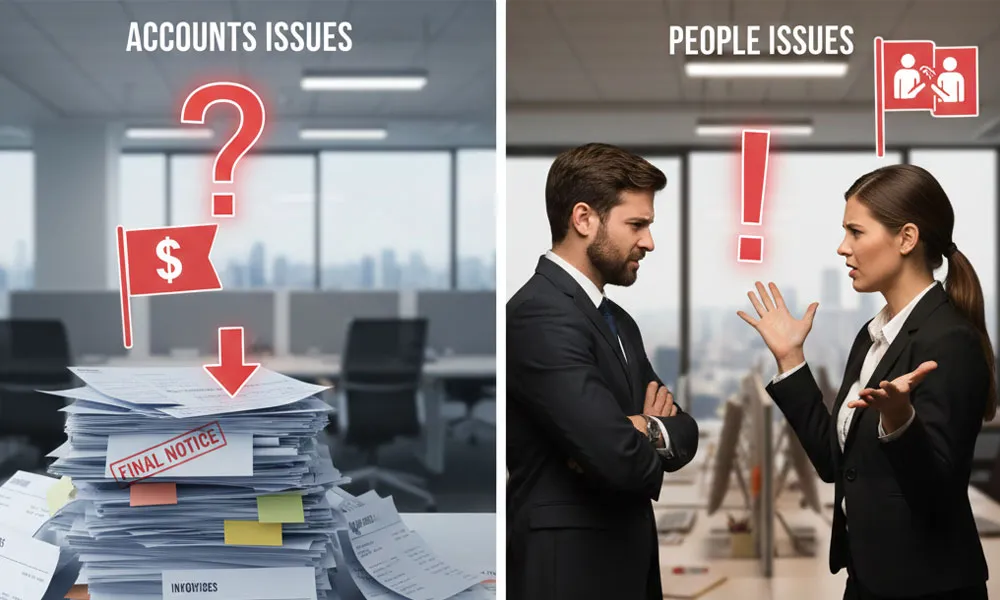

Don’t Wait for Accounts Issues to Turn into People Issues

If your firm is seeing any of these warning signs, it might be time to reassess how you handle accounts payable.

When you hire a reliable remote accounts payable provider, you can turn AP from a cause of worry into a strategic asset. It lets teams work on people, growth, and new ideas while making sure everything is correct, compliant, and able to expand.

In a competitive industry, the businesses that come out on top are the ones that know when to establish their own teams and when to work with others.