Imagine this. You are in the midst of tax filing season and are desperately looking for an accountant. However, your HR team can’t fill the vacancies despite giving it their best.

No, this is not another doomsday prediction but a chilling reality that can affect your business if you do not take the necessary steps now.

Yes, the US market is currently experiencing a serious undersupply of accountants—a problem that is set to compound as 75% of today’s public accounting CPAs approach retirement. This is a problem you can solve by deciding to outsource bookkeeping.

But wait. Won’t AI or accounting software do the job?

Sadly, no. AI or accounting software like QuickBooks can never fully replace the need for accountants or independently handle accounting for small businesses. To know why, you can read this blog.

Now coming back to our topic, the main reason behind the long hiring cycle is a demand–supply mismatch. There aren’t enough accountants in the US to fill the available vacancies, as we explain below.

1. Problem: Demand Supply Mismatch

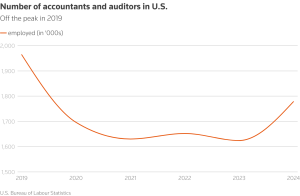

For instance, the US Bureau of Labor Statistics says that there were about 1.78 million accountants working in the US in 2024, about 10% fewer than in 2019. The reason for this decline is that many seasoned accountants retired in the meantime, without a reliable pipeline of qualified replacements.

Figure 1Number of accountants and auditors in USA

Factors like long working hours, low pay, fear of automation, additional year of study, have created stigma about accounting- leading to fewer students willing to major in accounting. The demand for accountants, however, remains strong. The US Bureau of Labor Statistics predicts a 6% growth in accountant and auditor jobs between 2023 and 2033.

This demand supply mismatch has created a big shortage of accountants, forcing businesses like toy maker Mattel to delay annual reports and other key filings.

So, what are businesses doing?

2. Current Hiring Strategy

The go-to strategy for most firms has been to hire accountants from India, China, Canada, and the Philippines. However, difficulties in securing H1B visas have restricted the availability of skilled professionals from these countries. For example, data shows that over 1 million skilled Indians are currently waiting for high-skilled immigrant visas.

This has forced some businesses like RSM US to increase its Indian workforce. Other mid-sized accounting firm like Eisner Amper and BDO have also started directly hiring accountants from Indian campuses. But directly hiring from India can be tricky if you are a small and medium business. Therefore, the best alternative for you is outsourcing or opting for remote hiring solutions.

3.Outsourcing: The Savior

Given the current challenges in sourcing accounting talent for small businesses, outsourcing bookkeeping and accounting work is the go-to strategy for most US firms. Research shows the global finance and accounting business process outsourcing market was valued at US$ 60.31 million in 2023 and is expected to grow at a 9.3 % CAGR between 2024 and 2030.

Additionally, outsourcing these functions to firms that specialize in accounting and bookkeeping for small businesses can boost profitability. Here’s how:

3.1 Cost Savings

- Outsourcing helps you eliminate the costs associated with full-time salary benefits and other overheads, leading to around 50 to 60% cost savings.

- Outsourcing or remote hiring solutions also comes with flexibility, meaning you only hire for what you need.

3.2 Core Competency Focus

- When you outsource bookkeeping it frees up time and other resources of the business which you can then invest in your core competency areas.

3.3 Compliance & Accuracy

- Firms offering bookkeeping services for small businesses have expert teams to handle your bookkeeping or accounting tasks, leading to a reduction in errors and costly penalties.

- You can keep your records clean by adhering to compliance and regular audits.

3.4 Technology Access

- Outsourced teams have access to the latest software including zero and QuickBooks for real time data.

- They offer financial analysis, forecasts, and cash flow tracking to guide decision making.

4. Outsourcing Destination

If you are looking to outsource bookkeeping, the country choices are clear: India, China, Canada, and the Philippines.

- With Canada, there is no major cost advantage.

- Outsourcing to China may pose communication hurdles.

- Outsourcing to the Philippines also has its challenges, including difficulty in accessing top talent.

This leaves you with the most reliable option: outsourcing to India.

Why India?

India has a huge talent pool of accountants. There are over 400,000 Chartered Accountants and around 10,000 chartered financial analysts in the country. Moreover, the country is slowly becoming the world’s GCC capital and had 1600 GCCs in 2024. The big four accounting firms including Deloitte, PwC, EY, and KPMG together employed around 140,000-160,000 people in their Indian GCCs as of 2024.

Additionally, owing to the growing number of GCCs the CPA certification is also getting popular. So, the number of CPA test takers in the country has grown from 3,317 in 2022 to 5,236 in 2023. Further the number of CPA test takers in the country is expected to reach over 11,000 by 2025. Today, outside USA, India is the largest market for CPAs. The country overtook Japan in 2023 to claim the second spot after US and had already overtaken South Korea and Canada in the recent past.

Moreover, the country has a huge English-speaking population which makes communication easy. And the favorable time-zone difference makes scheduling easy.

Final Words

There is an undersupply of accountants in the US. The problem will compound as the current batch of CPAs nears retirement age, with no reliable pipeline of qualified talent. Given this, your business can address demand by outsourcing or through remote hiring solutions. Connect with Remote Resource®, a leading provider of remote hiring solutions, to learn more and get started with a one‑week risk‑free trial.